We Were Shocked by the Royal Hawaiian Deal. Sonder Collapse? Not So Much.

Once hyped as the future of hospitality, Sonder took on long-term leases to operate apartment-style hotel rooms, that is, until the cash ran out. It’s now part of the not-so-exclusive club of overhyped SPACs that flamed out, joining the likes of WeWork and Vacasa.

Let’s be honest: the collapse of Sonder wasn’t shocking. The red flags were everywhere: mounting losses, desperate pivots, and a licensing deal with Marriott that smelled more like desperation than a long-term play. What was surprising? Just how poorly Marriott handled the whole thing, from due diligence on the deal to guest experience on dissolution.

After cutting ties with Sonder just days before it filed for bankruptcy, Marriott left guests scrambling, many mid-stay, with little more than a vague “we’re here to help” email. Some were told to leave immediately, with no rebooking support, no credit, and no clear answers. A few guests didn’t even realize they’d booked with a Sonder property, because they booked through Marriott. So much for brand promise.

For a company that prides itself on consistency and guest trust, this was an unforced error. Licensing 140 properties (7,700 romes) with a partner that couldn’t integrate properly, couldn’t sustain operations, and clearly didn’t have a solid runway? That’s not just a Sonder problem; that’s a lapse in Marriott’s strategic judgment.

And the signs weren’t subtle. Weeks before the collapse, Sonder disclosed in SEC filings that it was at risk of delisting, lacked enough liquidity to operate for the next 12 months, and had ongoing legal issues, including an investor lawsuit over accounting errors.

Meanwhile, Marriott had just launched “Sonder by Marriott Bonvoy,” a co-branded soft-brand collection built around this shaky foundation. That 20-year agreement lasted about 14 months.

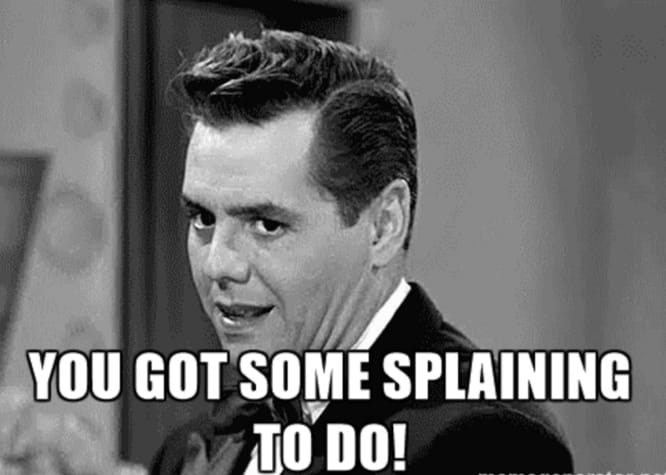

Someone’s got some ‘splaining to do?